Sometimes taxes can be a problem for your business, especially when you have no idea how to manage them. The good news is that the internet offers infinite solutions and that is why this time we will show you the platforms to manage your taxes. We will show you the most known platforms today so that your business can move forward and comply with this type of requirements.

In fact, do you know that online companies charge taxes to more than 130 countries? This is a reality that seems difficult to face when you just start in the world of online commerce. The truth is that as the company grows, its responsibilities increase but it does not have to be a problem, after all, the higher the growth, the higher the profit.

The key to success in many companies is not only to be constant, but it is also to avoid fines. For this reason, you must be clear that, for example, certain rules change constantly and end up varying depending on what is sold and where it is sold. There are certain complexities that, keeping them in mind and having a good platform, you can overcome without inconvenience.

Platforms to manage your taxes

Stripe Tax

It is an optimized platform for calculating taxes; it works for more than 35 countries, including the USA (all its states). Once you know where to collect your taxes, you only need to activate the function which will only take a few seconds.

This platform is compatible with national registries, such as the European VAT one-stop shop, as well as Canadian provincial and national registries. Using it is very simple, as you only need to add a line of code to your website or simply click a button on the dashboard.

You will have the option to collect taxes automatically, since this platform determines the location of your customer, thus calculating of the correct amount according to their geographic location. It also validates the VAT ID of the European Union, as well as the ABN of Australia in case you require it.

Likewise, you will be able to file and send your tax returns in the easiest way possible, as Stripe Tax streamlines this process. And these are just some of the most relevant features.

Quaderno

This platform is compatible with Amazon, Shopify and WooCommerce. In Quaderno, you can have a system that has tax information for any country/region, which makes it an excellent alternative in the case of international sales.

This platform also has an API that will allow you to securely access sales data while automating the rest of the processes for the generation of sales tax in a matter of seconds.

You will be able to integrate it seamlessly into your website, whether it is a content page, payment processor or shopping cart. In addition, it also works perfectly with multichannel sales. As you can see, this is a reliable option when you want to comply with taxes in any country, since you will also have the option at all times to track each of your sales in more than 1000 jurisdictions. Finally, this platform is in charge of alerting you to any type of complication or registration required.

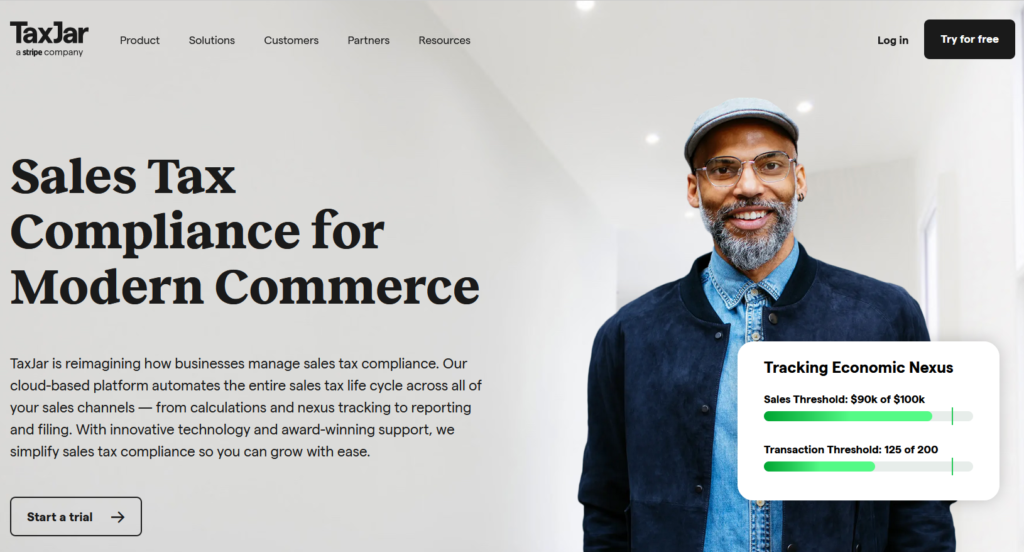

TaxJar

This is a website launched by stripe and it is a platform that is based on the cloud, so it allows you to automate all the taxes of the sales made. Taxjar is one of the most reliable options, especially considering that more than 20,000 companies rely on it.

Here, you will be able to enjoy very useful functions such as making calculations and filing reports, making it very efficient software when you want to keep your online business up to date. But among its features, you do not have to worry about deadlines because your reports and remittances will be completed automatically, and you can also attach all the data that comes in as your business expands, likewise you will have the option of having files by state for better financial organization.

Regarding human mistakes, it is usual that they eventually occur and you can hardly escape from them. However, Taxjar allows you to automate this entire process in order to eliminate and correct any human mistake. Finally, thanks to its API, your customers will be able to see their tax data during payment.

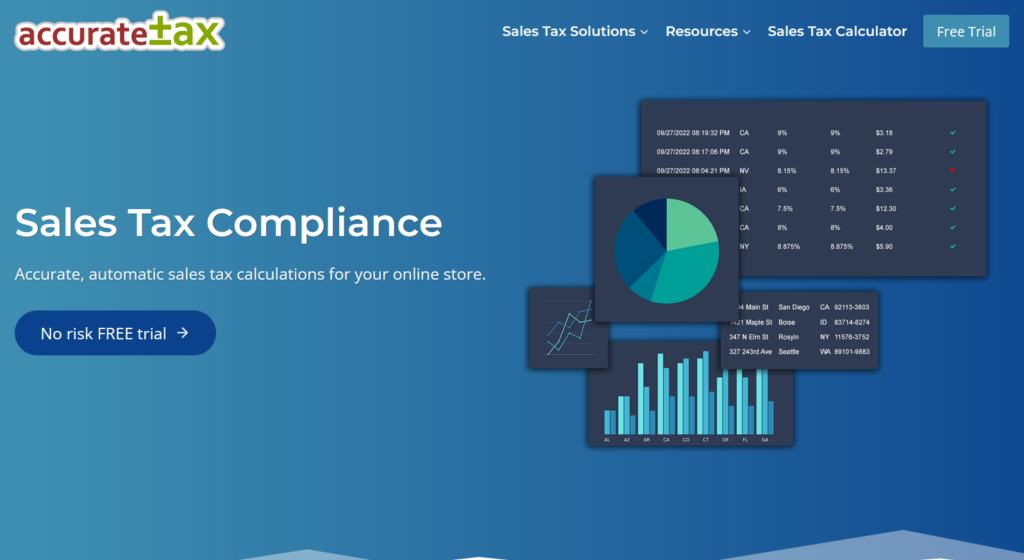

AccurateTax

This software is owned by NetBlazon, which is a company that has focused on offering an affordable tool when you want to have accurate tax generation. It is an exceptional option for micro-companies or startups that are just starting out in the world of online commerce, although it is also an excellent alternative for large companies.

It is a good option for online commerce in the USA, as it facilitates the calculation of accurate and up-to-date tax rates in each region of the country. In addition, in order to improve and facilitate the filing of sales tax returns, this software offers interactive usage reports as well as transaction details.

On the other hand, one cannot leave out its address cleaning tool in order to help with tax calculations and ensure that none of these are delivered to the wrong address.

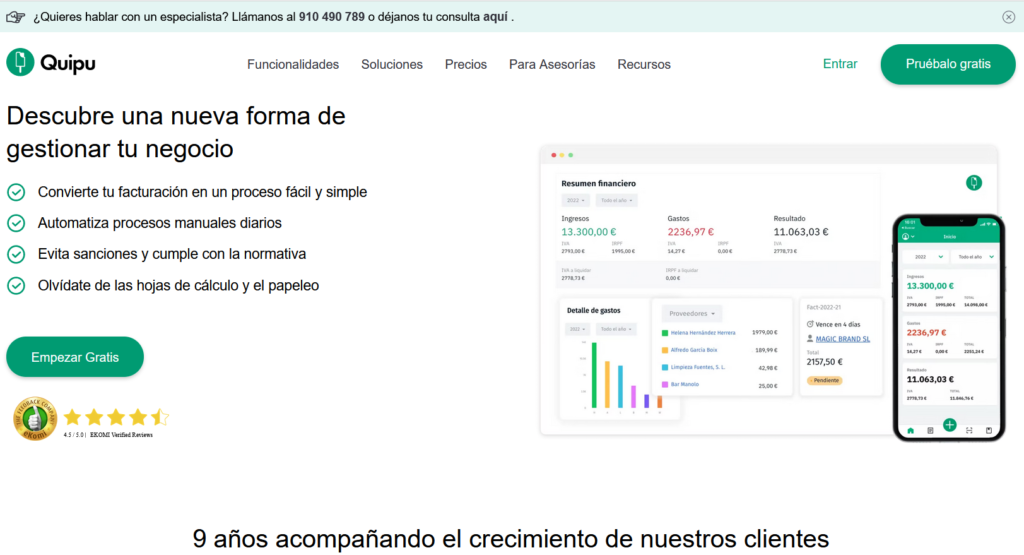

Quipu

It is invoicing software focused on freelancers and SMEs, for which it offers a solution in the administrative and fiscal management. With Quipu, you will be able to issue and send invoices to your clients, as well as create periodic and rectifying invoices.

Another relevant feature is that Quipu fills out the self-employed tax forms automatically. It is just a matter of uploading your income and expenses and the software will be in charge of calculating the taxes, as well as filling out the forms. Then, you will have everything ready to download and submit.

Best of all, you can forget about the idea of keeping paper invoices, as all this data will be stored securely in the cloud. For your safety, Quipu uses Amazon Web Services servers, so your information will be encoded and encrypted at all times.